trust capital gains tax rate 2019

Trustees only have to pay Capital Gains Tax if the total taxable gain is above the trusts tax-free allowance called the Annual Exempt Amount. Most investors pay capital gains taxes at lower tax rates than they would for ordinary income.

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

At just 13050 in taxable income trust tax rates are 37 plus the 38 tax imposed.

. 2022 Long-Term Capital Gains Trust Tax Rates. Income and short-term capital gain generated by an irrevocable trust gets taxed at high rates. Where the capital gain is attributed to the trust the effective rate of tax on a capital gain is 36.

More than one year. For example the top ordinary Federal income tax rate is 37 while the top. Ordinary income tax rates up to 37.

A capital gain of 200 that is eligible for the CGT 50 discount. A trustee derived the following amounts in the 201415 income year. What is the Capital Gains Tax rate for trusts in 2020.

In contrast married couples filing jointly are subject to the 37. HS294 Trusts and Capital Gains Tax 2019 This helpsheet explains how UK resident trusts are treated for Capital Gains Tax. Short-term capital gains from assets held 12 months or less and non-qualified dividends are taxed as ordinary income.

Some or all net capital gain may be taxed at 0 if your taxable income is. The 2019 estimated tax. This gap in income tax treatment has widened considerably under the TCJA.

The table below indicates capital gains rates for 2019. Guidance about the tax-free allowance and telling HMRC about capital gains made by a trust has been updated. The tax rate on most net capital gain is no higher than 15 for most individuals.

It also deals with situations where a person disposes of an. The trust deed defines income to include capital gains. The maximum tax rate for long-term capital gains and qualified dividends is 20.

For tax year 2019 the 20 rate applies to amounts above 12950. Estimated Payments for Taxes. 2022 Long-Term Capital Gains Trust Tax Rates.

The first payment for a calendar year filer must be filed on or. For instance in 2020 trusts reach the highest tax bracket of 37 federally at taxable income of only 12950. The following Capital Gains Tax rates apply.

One year or less. Capital Gain Tax Rates. Capital gains and qualified dividends.

For example a single individual with 172925 of interest income and no deductions will pay. For tax year 2020. Find out more about Capital Gains Tax and trusts.

For tax year 2019 the 20. The tax-free allowance for. 2018 to 2019 2017 to 2018 2016 to 2017.

Because tax brackets covering trusts are much smaller than those for individuals you can quickly rise to the maximum 20 long-term capital gains rate with even modest profits. 6 April 2019 Rates allowances and duties have been updated for. The maximum tax rate for long-term capital gains and qualified dividends is 20.

Due on the 15th day of the 4th month after the tax year ends.

:max_bytes(150000):strip_icc()/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

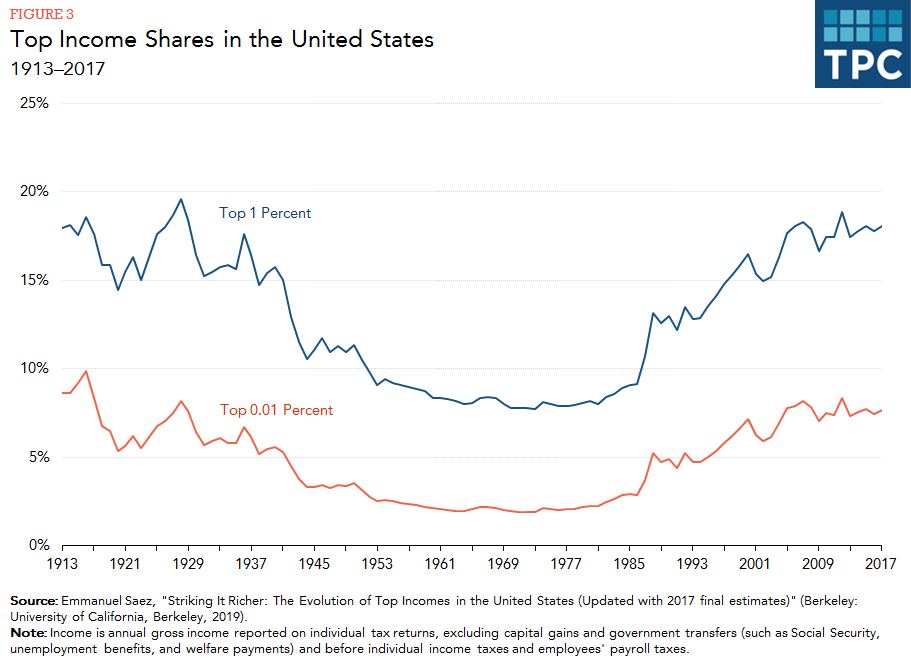

How Do Taxes Affect Income Inequality Tax Policy Center

Types Of Itr Forms For Ay 2021 22 Financial Literacy Form Individuality

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

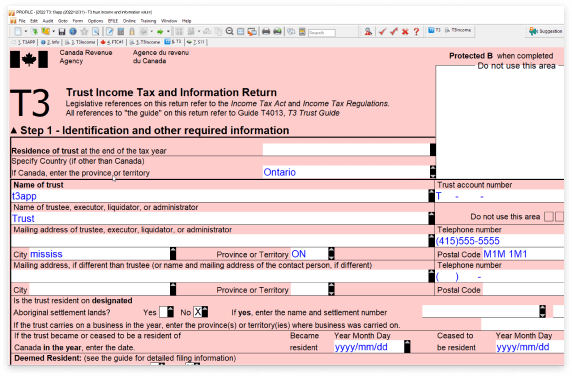

T3 Trust Tax Preparation Cra Efile Software Profile

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Figure Pay Qualities With Our Free Pay Charge Instrument That Will Pull In Salaried Stars Of Government And Private D Income Tax Return Income Tax Filing Taxes

Maximize Next Generation Assets With Intentionally Defective Grantor Trusts Bny Mellon Wealth Management

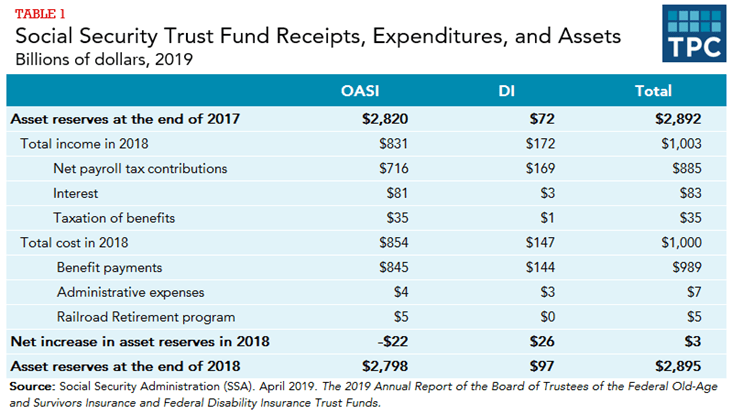

What Are The Social Security Trust Funds And How Are They Financed Tax Policy Center

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

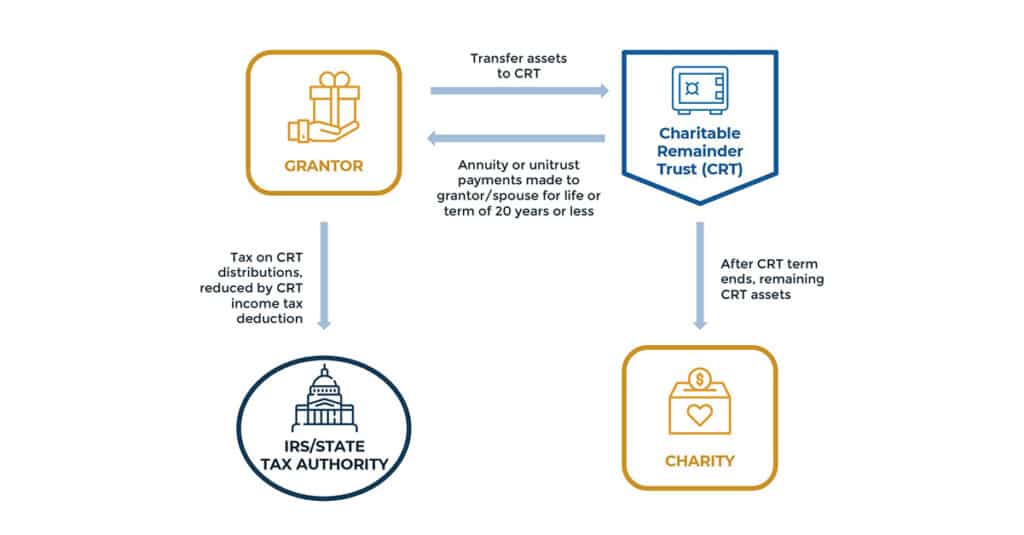

Charitable Remainder Trusts Crts Wealthspire

Forget Smooth Earnings Focus On Profitable Growth Bain Company Real Estate Investment Trust Growth Earnings

:max_bytes(150000):strip_icc()/ScreenShot2021-02-10at4.22.05PM-66a7ee46923a4474b907ce6f25ca8bce.png)

Form 2439 Notice To Shareholder Of Undistributed Long Term Capital Gains Definition

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Investing For Income In Retirement Bond Funds Real Estate Investment Trust Option Trading

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Financial Freedom Workshops 4 Free Workshops Tickets Multiple Dates Eventbrite Financial Freedom Financial Free Workshops